I first learned about ‘retainage’ when I visited a client who was a contractor generating over 5 million a year in revenue. I asked him if he knew how much his clients owed him, he told me he had no clue.

I was astonished, how a contractor who works on Park Avenue in Mid-town Manhattan has no idea how much money he’s owed.

I asked “what’s with you”. His reply, “AIA Billing and retainage”. AIA billing is the invoice form used to request payment on the percentage of work completed. I learned the meaning of “retainage”.

Retainage is the process by which the owner/general contractor withholds a defined percentage of payment until completion of the project. This practice (retainage) dates back to the construction of the railroad systems in England in the 1800s to ensure that the contractor would complete the work.

The real-life implications for the Contractor are that until the contract is signed off as complete…the contractor will not receive the retainage amount. This could be anywhere from 5 to 20 percent.

This translates into cash flow problems and accounting nightmares. Keeping track of how much you are owed and when you are getting paid on one job is very difficult. When you have multiple projects nearly impossible.

Contracts may contain a clause with 10% retainage for the first 50% of the project and then 5% retainage for the balance of the project.

Let’s discuss a one-million-dollar project with an estimated $300,000 gross profit (30% margin)

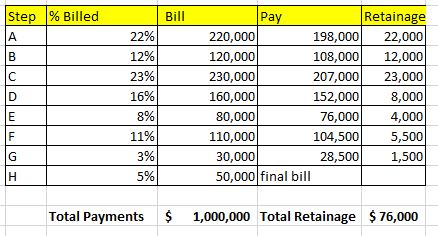

The contract’s retainage is as follows:

10% for the 1st half of the job

5% for the 2nd half of the job

Your payment stream is illustrated in the below chart:

The 1st 50% of the job, Steps A to C, the retainage is 10% on each bill so you are receiving 90% of the billed amount. In the event, that the bill is above 50% of completion and below 50% of the completion at the same time you will keep the retainage at 50%. This is the case in Step C.

Once you have completed 50% of the job as shown in Steps E to G on you will receive 95% of the invoice.

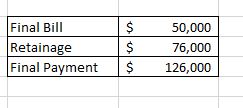

Step F is interesting as that is your final bill. In this case you would send in the bill for $50,000 and the retainage is now paid ($76,000). The final payment will net $126,000.

Looking at this situation from a pragmatic point of the view, the final payment of $126,000 represents 42% of the projected job profit of $300,000. If this project from start to finish is a six-month project you are waiting a long time

The above chart represents one project. If you have 10 projects happening at once, how do you manage this process manually?

We recommend automating this process. Our research has found that www.knowify.com has provided a platform to track each detail and push the information into your accounting system automatically. No double entering information. Human error is minimized and hours of work reduced.

When setting up this program it is important to partner with an expert such as EWBizservice.com which has proven expertise in both AIA billing and Accounting.

Disclaimer:

This information contained in this site is general in nature and should not be considered legal, tax, accounting, consulting or any other professional advice. As your particular factual situation for advice is dependent on your particular situation you must consult with an adviser familiar with your situation. These links are being provided as a convenience and for informational purposes only; they do not constitute an endorsement or an approval of any of the products, services or opinions of the corporation or organization or individual. We bear no responsibility for the accuracy, legality or content of the external site or for that of subsequent links. Contact the external site for answers to questions regarding its content.